Diversifying your equity income

portfolio

How advisers can build a diversified equity income portfolio amid the coronavirus threat

Equity income funds are intended to grow an investor's capital and produce an (often rising) income, by investing in companies which pay dividends, which means they tend to bias to major blue chip stocks.

And currently, a tiny number of stocks occupy the top ten positions in a majority of the 84 UK Equity Income funds currently available to advisers in the UK, according to data from Octopus dated 22 January.

Of the 84 funds in the IA UK Equity Income sector, pharmaceutical company GSK was held as a top ten position in 64 of them, which equates to 76 per cent, according to the data, which was sourced from Lipper and from fund factsheets.

In the middle of a volatile market, exacerbated greatly by the coronavirus crisis, investors will be looking at how they can diversify their equity income portfolio.

In this report, we will look at what the future could hold for the world's major markets and how advisers can build a diversified equity income portfolio.

US equities are a good income diversifier

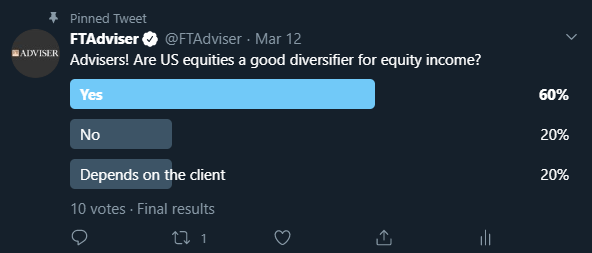

More than one in two advisers think US equities are a good diversifier of equity income despite recent market turbulence, according to the latest FTAdviser Talking Point poll.

The poll asked advisers the following question: “Are US equities a good diversifier for equity income?”

Over a half of advisers (55.6 per cent) said they think US equities are a good diversifier for equity income.

Just over a fifth (22.2 per cent) found US equities to not be a good source of diversification and the same percentage of advisers said this depended on the type of client.

The poll results are published amid a volatile type for markets, including US equities.

US equities have been volatile since the World Health Organisation confirmed the coronavirus to be a pandemic.

I’m surprised more advisers didn’t think US equities were a good diversifier for equity income.

David Holohan, head of equity strategy for Mediolanum International Funds, said he was unsurprised by the results.

“US Equities can offer a more meaningful contribution in terms of dividend yield after the recent declines with several industries, most notably in the more cyclical parts of the market offering very attractive dividend yields,” Mr Holohan said.

Scott Gallacher, chartered financial planner at Rowley Turton, echoed this view.

“I’m surprised more advisers didn’t think US equities were a good diversifier for equity income. They may be highly correlated to UK equities but you’d still reduce non-systemic risk by holding US equities alongside your UK equities.”

On Monday, the S&P 500 closed almost 8 per cent lower compared to the previous close.

Additionally, the Dow Jones Industrial Average Index was also down 8 per cent session-on-session.

This comes after the S&P 500 suffered a 9.5 per cent drop since Black Friday in 1987.

On Sunday the Fed cut interest rates to almost zero, a second emergency move aimed to stimulate the economy.

The move means the borrowing rate range is between 0 and 0.25 per cent.

At the time of writing, the coronavirus has infected more than 179,558 and claimed the lives of 7,067.

But the long-term prospects for US equities remain positive despite the market turbulence and rising death toll as most commentators believe the pandemic would only hit US equities in the short-term.

Obviously the short-term outlook is negative in terms of the impact of coronavirus and the various policy responses to it. However, in any situation there will still be some winners.”

Mr Holohan said: “Over time US companies have emerged as leaders in their respective fields on a global basis and management teams operate with a returns focused mindset supported by a strong track record of generating strong shareholder returns.”

He added: “The recent market turbulence will not change these factors, which have helped US equities perform well for decades.”

Mr Gallacher agreed and thought recent weakness in US equity markets may have created buying opportunities.

“Obviously the short-term outlook is negative in terms of the impact of coronavirus and the various policy responses to it. However, in any situation there will still be some winners.”

The immediate outlook for US equities will be volatile, given that news flow has the potential to deteriorate further on the coronavirus and even with intervention, we are likely to see a significant hit to the economic data and corporate earnings.

He added: “Though that’s not to say that further falls aren’t to come and there may be even greater opportunities in the future.”

But Anthony Willis, investment manager in the BMO multi-manager team struck a more cautious note.

“The immediate outlook for US equities will be volatile, given that news flow has the potential to deteriorate further on the coronavirus and even with intervention, we are likely to see a significant hit to the economic data and corporate earnings.”

He said he doesn’t think the “US equity market has bottomed yet”, but at some point in the future markets are likely to rebound due to an expected global medical response and a significant fiscal package.

But he concluded: “For long-term investors, an attractive entry point may well be coming but there are still downside risks in the short-term.”

How advisers can build a diversified equity income portfolio

Words: David Baxter

Images: Fotoware

The need for a diversified source of equity income was an urgent issue long before the coronavirus struck.

A combination of share price gains and hefty dividends, particularly in the UK, proved useful for clients with income needs and investors seeking a more defensive source of equity exposure.

But UK equity income funds have long remained reliant on a handful of big payers, creating dividend concentration risk, while other regions vary in terms of yield on offer and total returns.

The average income-focused fund in the Investment Association (IA) North America sector yielded just 2.3 per cent in early January, according to FE data, compared with some 4.5 per cent from the average IA UK Equity Income fund and 4.6 per cent from the average IA Asia Pacific ex Japan fund with an explicit focus on income.

While it might not feel like it, we remain still in the very early stages of coronavirus and therefore assessing its impact on the global economy remains difficult.

But if equity income investing seemed a daunting task even at the end of 2019, the impact of Covid-19 has entirely transformed the equation.

The enormous market sell-off witnessed in recent weeks has seriously challenged assumptions about the defensive qualities of equity income approaches, for one.

It has also exposed weaknesses in the UK market, which has been hit much harder than other regions due in part to added pressures from a price war in the oil industry.

While some investors smell bargains, the economic damage inflicted by the coronavirus lockdown will inevitably be deep while remaining difficult to quantify.

“While it might not feel like it, we remain still in the very early stages of coronavirus and therefore assessing its impact on the global economy remains difficult, other than the obvious immediate shock given the closing or borders and people being confined to their homes,” explains Ryan Hughes, head of active portfolios at AJ Bell.

“It is inevitable that many companies will now suspend or reduce their dividends and this will have a direct impact on those funds that are focused on paying out income to investors.”

In this context it is hard to tell just which companies will be able to keep paying dividends, or survive altogether, in the coming year.

This means that building a diversified source of equity income is important, but so is taking an extremely selective approach.

Recent performance

Because dividend-paying companies are supposed to take a more prudent approach than some of their peers, the equity income funds that invest in them are usually expected to lag their growth-oriented peers in rising markets but suffer less at moments of volatility.

However, on an aggregate basis the defensive characteristic of equity income has failed to materialise so far in this sell-off.

The FTSE All Share made a stunning year-to-date loss of 33.5 per cent to 18 March, with the FTSE 100 down 31.9 per cent.

However, the average IA UK All Companies fund has struggled more, losing 34.2 per cent.

And the fallout has been even worse for the average IA UK Equity Income fund, which is down 34.9 per cent over the same period.

A similar dynamic applies further afield over this period, if the losses have been less severe.

The entry point to equity income looks appealing as it has been oversold compared with the rest of the market and the yields have looked attractive even before the crisis, but quality is key and dividend traps need to be avoided

The average IA Global Equity Income fund shed 21.4 per cent in sterling terms, compared with an average loss of 19.5 per cent in the growth-oriented IA Global sector.

The MSCI World index dropped by 16.8 per cent over this period.

Taking share prices at face value, investors may now sense a bargain.

Having looked expensive on various metrics in recent years, equities might be at a level that seems attractive for those with a reasonable time horizon and the ability to stomach the inevitable ups and downs of markets.

UK stocks, which looked cheap relative to some of their peers before 2020, may now seem even more so.

The same thinking can apply for adventurous equity income investors, given that yields move inversely to prices.

In theory, you can now secure the same dividend in terms of a cash amount from a company, but at a cheaper share price than before.

Funds in the space should be able to take advantage of this.

But caution, and a serious consideration of the fundamentals, would be advised here, because many companies and sectors could see their earnings and dividends struggle in the face of the economic shutdown aimed at halting the spread of the virus.

And while some sectors may seem like obvious winners or losers from the current situation, it is worth assessing the bottom line.

“Equity income is looking very interesting right now,” says Adrian Lowcock, of Willis Owen. “The headline yields are eye-watering, but of course they all have to be taken with a massive pinch of salt.

“The entry point to equity income looks appealing as it has been oversold compared with the rest of the market and the yields have looked attractive even before the crisis, but quality is key and dividend traps need to be avoided.”

Winners and losers

Some sectors have obviously struggled.

The tourism and hospitality industries will take a huge hit, as will the likes of airlines.

Similarly, equity income investors will be hit harder in certain regions because of the structure of the underlying market.

In the UK, the pronounced difficulties of equity income funds in part relate to the composition of the market and where dividends come from.

The oil price war that broke out between Saudi Arabia and its rival producers in early March has meant that big dividend payers such as Shell and BP have seen their share price woes intensify amid the coronavirus sell-off.

Some sectors are going to be hit harder than others, such as the airline industry

Other dividend-paying sectors have also struggled, in the domestic market and globally.

Banks in the UK and beyond fare best in environments of high or rising interest rates, meaning the emergency cuts enacted around the world will trouble both their share prices and balance sheets.

However, share price moves and dividend yields do not tell the whole story.

As Mr Lowcock notes, companies’ fortunes – and dividend payments – depend in part on whether they are well positioned for difficult times.

“Some sectors are going to be hit harder than others, such as the airline industry,” he says.

“Before the crisis, British Airways owner International Consolidated Airlines Group had a decent yield, but in the light of events it is hard to see that being maintained or returning any time soon.

“Likewise oil majors are going to be under pressure but they have historically been able to ride the rough patches out.”

As such it is useful to assess where funds – in the UK and beyond - invest by sector, and how much of a focus they have on metrics such as dividend cover and overall balance sheet strength.

Many trusts that focus on income have a decent income reserve and therefore may be in a position to maintain their dividend this year despite the cuts that will come from companies

It will also be instructive to see which companies cut or reduce their dividends and why.

On the same note, investors would do well to have a balance of geographical exposures, given that companies around the world will fare differently with the coronavirus crisis.

If China recovers more quickly than Europe, for example, Asian equity income funds could receive more of a boost.

For example, pub chain Marston’s recently announced a dividend cut as it looks to weather the current storm, as did betting company William Hill, which has been hit by a slew of sport event cancellations.

Tech name Micro Focus scrapped a payout in response to the current turmoil.

But some who alter their dividend plans may fare well in the crisis.

WM Morrison has scrapped a planned special dividend to boost its resources for coping with the current situation, but could be in a sector that ultimately benefits from the crisis as shoppers panic buy items.

Funds

Mr Lowcock notes that companies with less sensitivity to economic activity should be the best income sources, meaning so-called “quality” shares could continue to outperform as they have in recent years.

He favours funds such as Threadneedle UK Equity Income, a high-conviction name that has the flexibility to invest across different parts of the market.

Diversifying across different areas, using not just UK equity income funds but those operating in different regions or with a global remit, could also help.

But given that even companies in a strong position may cut their dividend merely as a precaution, it is likely that many funds will generate less income in the next year or so.

“For [open-ended] funds, the rules state that they have to pay out all of the income they accrue each year and therefore investors should expect income to fall from these funds as companies restrict what they are paying out,” Mr Hughes adds.

As such, investors may need to lower their expectations in the shorter term – though buying quality dividend-payers at cheaper valuations could make generating income easier in the future.

But some other routes are available.

In the open-ended space, some equity income funds sell put options on their holdings and use the fees for this activity to boost their yield.

This practice can reduce such funds’ capital gains in rising markets, but may help to boost the income available.

Another route is via the investment trust sector, where many names have long records of increasing their dividends each year. An advantage some trusts have is the ability to pay income from their capital reserves in difficult times.

“Many trusts that focus on income have a decent income reserve and therefore may be in a position to maintain their dividend this year despite the cuts that will come from companies,” says Mr Hughes.

However, as with companies, investors should look closely at trusts to see which are well equipped to get through difficult conditions.

Analysts at Stifel, a broker, recently warned that “newer trusts with little in reserve, those investing in specialist assets and those returning capital to shareholders by way of dividends may be especially at risk of dividend cuts”.

Investors should therefore consider diversifying across these vehicles, as well as regions, but keeping a close eye on quality and fundamental metrics such as cash reserves and balance sheet strength.

Equity income investing will not be an easy ride in the coming months.

Company culture is as important as technology in helping firms deal with the coronavirus crisis

Every chief executive thinks about, and fears, the black swan events that could threaten their business.

The obvious nature of black swans makes this no easy task.

Some scientists have argued that the current pandemic crisis was a known threat and was, perhaps, inevitable.

Black swan or not, Covid-19 is having a dramatic societal and economic impact.

The question for chief executives now is: “how resilient is my business?"

This is the main topic of discussion in all FTSE 100 management teams.

How do we operate if a significant proportion of staff fall ill?

How do we help slow the spread of the virus?

How do we maintain service levels?

Most importantly, how do we keep staff safe?

Every chief executive thinks about, and fears, the black swan events that could threaten their business.

Investment management companies, such as Schroders, also have a specific challenge: are we confident that trading operations will stand up, regardless of levels of staff absence?

For companies only recently offering serious consideration on how to respond on some of the broader points, it may be too late to offer effective solutions.

For those who have planned for this sort of black swan, the answer lies partly in technology.

But of equal importance is a company’s culture and the relationship it develops with its workforce.

The strength of this social contract is critical at times of crisis. It is now being tested.

Being prepared

Forward-looking companies have been rightly battling over offering the best working environment, be it a state-of-the-art gym or access to an on-site doctor, or maybe even a dentist.

By empowering staff with genuinely agile working, you establish a deep relationship of trust.

But now, looking through the lens of the coronavirus pandemic, this was only level one of that contract.

The next level, it is becoming clear, is the test of whether a company can care for its staff – and the interests of clients and customers – when the system is exposed to extreme stress.

Technology is at the heart of this solution.

We looked at this after I became chief executive of Schroders in 2016.

The management team identified that to establish true cross-business collaboration and business resilience, technology would be the solution.

Unhindered flexible working was the aim.

By empowering staff with genuinely agile working, you establish a deep relationship of trust. So we invested.

We began by rolling out a system that allows people to work anywhere from any location at any time using just one log-in.

They get full access to the systems they would usually get in the office; our client services teams can talk to clients, our fund managers can place trades.

It should be remembered that two million people who work in the gig economy lack a social contract, and we must think deeply about the implications for them at a time of stress. They are the real losers from this pandemic.

This allowed us to empower staff to work the way that was best for them.

It wasn’t just about being able to work from home, it meant they could mix in with other teams in our new offices.

The building, after all, was purpose-built for this type of agile working. Collaboration has increased exponentially.

So when we made a decision earlier this month to move to split-team working, it wasn’t daunting.

Staff flexibility

The decisions made several years ago – to offer staff true flexibility - had put us in a strong position for the situation we faced.

The first challenge – to divide more than 5,000 people, across 34 locations into two teams, which would alternative home and office working – was straightforward.

We had begun in Asia earlier in the year and now needed to roll it out globally.

Then this week a move to “minimum viable presence” – ensuring necessary cover in the office but with connectivity for most staff from home – was the next step, based on new government guidance.

Again, the change was made smoothly and efficiently. The key to this was that the technology was reliable and versatile.

Virtual office

With our virtual desktops, portfolio managers, analysts and traders get exactly the same experience in a disaster recovery site, at home or in the office.

They immediately tap into the tools that have transformed our working practices.

Previously manual processes have been swept away by Aladdin, a risk and portfolio management tool.

Nobody can know what the next black swan will be or when it will emerge, but that does not stop a company from being prepared for it.

Collaboration tools, messaging and chat applications help the traders stay coordinated with fund managers and operations while Bloomberg IB Chat and Symphony also allow secure messaging with brokers and counterparties.

The list of new technologies goes on, and they are all available to our teams.

It means that today, I’m writing this from home.

I, and the entire company, can work away from the office with confidence, regardless of the tasks performed.

This approach helps protect our business operations but, most importantly, it keeps our staff safe and helps control the spread of the virus.

Frankly, I think this is how all businesses should work.

This is not just flexible working; it’s about the deepening of our social contract with employees, it’s about putting our trust in them at all times, crisis or no crisis.

Nobody can know what the next black swan will be or when it will emerge, but that does not stop a company from being prepared for it.

Empowering employees through constantly evolving technology is what makes this possible.

More broadly, it should be remembered that two million people who work in the gig economy lack a social contract, and we must think deeply about the implications for them at a time of stress.

They are the real losers from this pandemic.

Peter Harrison is chief executive of Schroders